Aave [AAVE] Signals Potential Price Recovery Amid Rising DeFi Activity and Declining Exchange Reserves

Aave [AAVE], a prominent player in the decentralized finance (DeFi) sector, has shown signs of a rebound after a recent downturn. The altcoin has experienced a 6% price decline in the last seven days but managed to bounce back by 2.3% in the last 24 hours. This recovery suggests a potential uptrend, with several bullish signals from technical indicators pointing towards a possible price increase.

Bullish Indicators and Technical Analysis

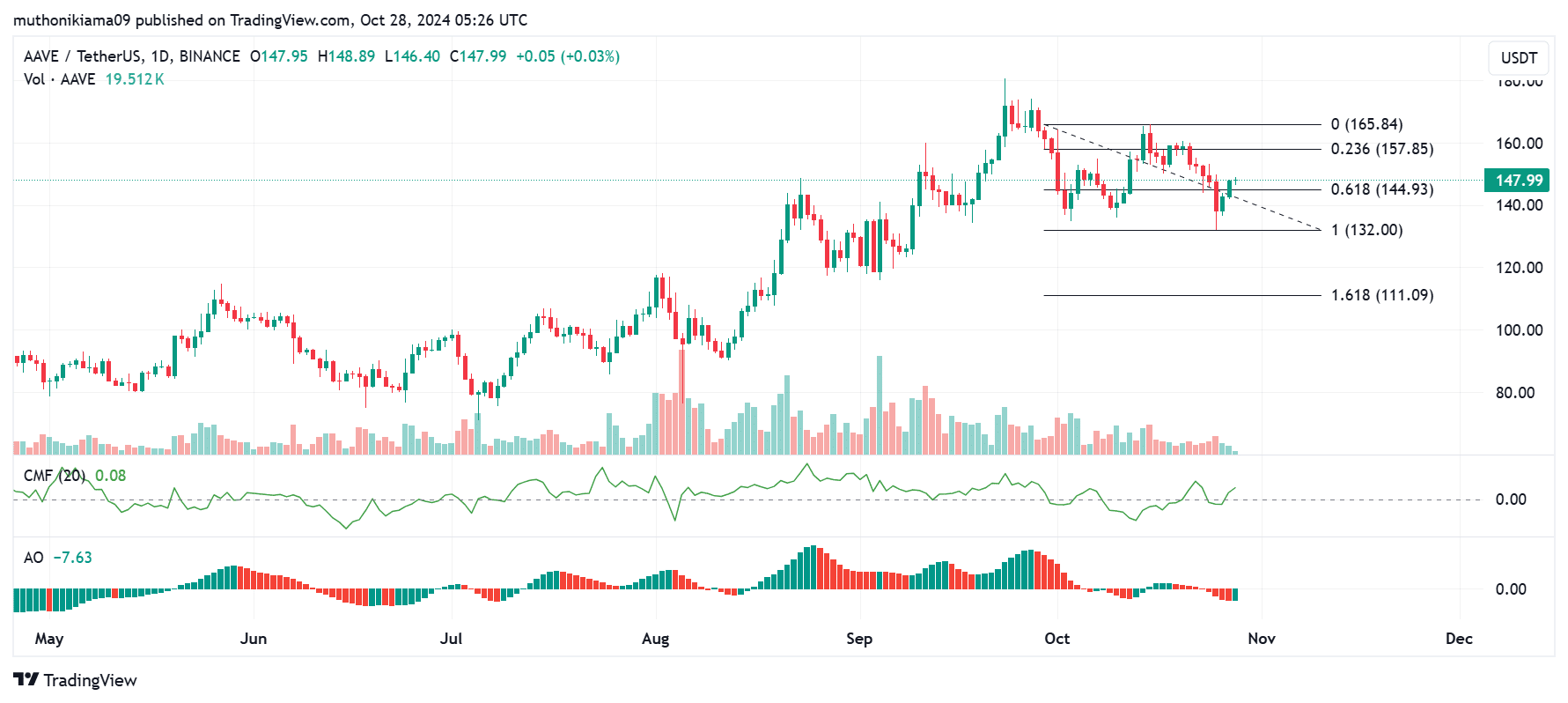

According to the daily chart analysis, the bearish trends appear to weaken as the Awesome Oscillator (AO) flips green. This indicates a potential trend reversal, although the AO is still negative, signaling that bears are still in control. The Chaikin Money Flow (CMF) goes further in supporting the bullish thesis by trending upwards and flipping to positive. This suggests that buying pressure now outweighs selling pressure, which may lead to a rally.

If these bullish signs strengthen, Aave [AAVE] could reach the next resistance level at $165, according to the 0.236 Fibonacci level ($157). Breaking through this level could pave the way for a further rally towards $165.

Exchange Reserves Plummet and DeFi TVL Growth

Declining Exchange Reserves

Data from CryptoQuant indicates that Aave’s exchange reserves have dropped to record lows, suggesting a weakening of selling pressure. Since mid-October, exchange reserves have been declining steadily, despite minor price bounces. This indicates that fewer AAVE tokens are available on exchanges for sale, giving room for a potential price recovery.

Improved DeFi TVL

Aave [AAVE] is also poised for significant price recovery due to its growing DeFi Total Value Locked (TVL). As of press time, the TVL stood at $13.05 billion, according to DeFiLlama, and has increased by nearly $500 million since the beginning of the month. A surge in DeFi activity often leads to increased entrants, boosting demand for the native token AAVE, which is essential for supporting transactions on the protocol.

Holder Sentiment and Profitability

At press time, nearly 57% of AAVE holders were profit-taking, as per data from IntoTheBlock. Around 18,000 addresses bought AAVE above $155, indicating strong buying activity among token holders. While these factors suggest that AAVE is nearing its most immediate resistance, they also show potential buying pressure that could sustain its uptrend.

Conclusion and Call-to-Action

Given the current technical indicators and on-chain metrics, Aave [AAVE] appears to be preparing for a significant rebound. The combination of declining exchange reserves, growing DeFi activity, and increasing buyer sentiment positions AAVE favorably for a price rise. To stay updated on all the latest developments within the cryptocurrency market and for in-depth analysis, visit [Archynetys]().

Stay informed and invest wisely!